in Central and Eastern Europe

across Poland

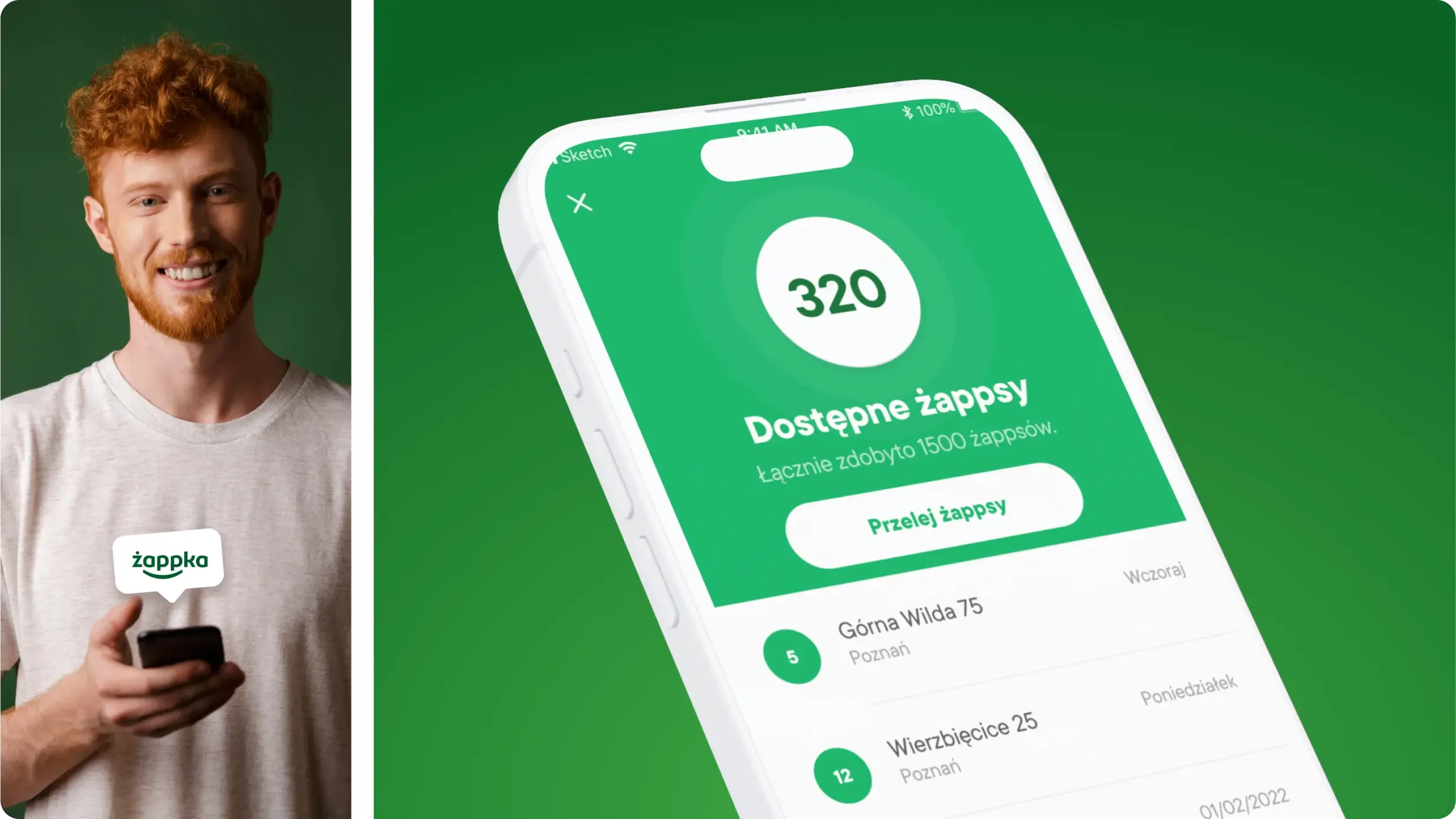

of B2C mobile app “żappka”

across Poland

across Poland

across Europe

As Żabka was coming to dominate Poland’s convenience retail landscape with thousands of stores across the country, the company realized a mobile app was the natural next step in its development.

Having recently completed another successful mobile app project for Żabka, we were asked to build this core element of the company’s “store of the future” concept: the B2C żappka application.

One of its main goals was to provide Żabka’s customers with engaging, personalized experiences by leveraging state-of-the-art data analytics and marketing automation.

Making this happen would require us to create a complex software architecture composed of numerous technologies, systems, and databases. To ensure smooth delivery of the final product, we launched the project by building a proof of concept.

Before we started the actual development of the żappka app, we recommended the optimal technology vendors and validated all our assumptions.

This allowed us to minimize project risk and prevent possible complications.

After completing the proof of concept, we started the development phase to bring to life the designs created by Ueno, the design agency you may know for its rebranding of Uber and subsequently being acquired by Twitter.

Our engineers worked according to the Agile methodology, which allowed us to continuously react to business requirements and user feedback.

This allowed us to perfect the implementation before the start of żappka’s TV and online marketing campaigns.

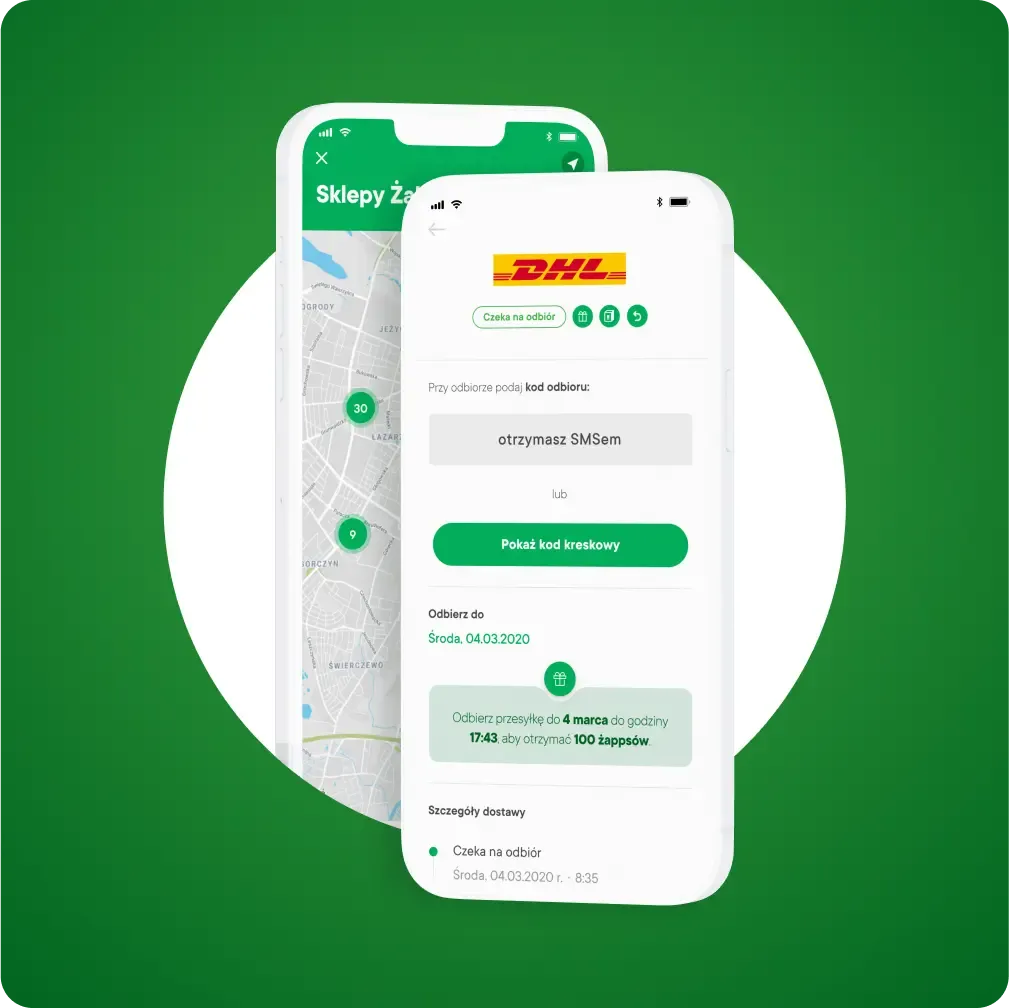

While the żappka app required integration with numerous systems to accomplish its ambitious goals, two solutions provided by our partners can be said to have brought exceptional value to the users since the start.

One of the main tenets behind żappka’s personalization is the Synerise platform that manages interactions in real time. To let the app take full advantage of this technology, we made sure most of its content could change dynamically, depending on the recommendations of the AI-based recommendation engine.

We also integrated żappka with Infobip, an omnichannel communications platform that enables the Client to interact with users via SMS messages. Our partner's solution is also responsible for handling phone number verification when a customer first starts using the service.

Upon launch, the app ensured high engagement and satisfaction with features like:

since launch

Winner in the Commerce/M-commerce category

Third Place in the Main Category

Future Mind has accompanied Żabka on the path towards dominance in the CEE convenience store industry

Read MoreAs an end-to-end solutions team, we partner with Clients to help them understand their customers

All services