In the latest European Retail Barometer report by our partner company, Solita, data monetization took center stage.

As data is increasingly emerging as a key revenue driver, we asked Future Mind and Solita experts to discuss the challenges of data monetization, the role of mobile apps, and the importance of striking the right balance between seeing new revenue streams and cost-saving measures.

Here’s their perspective on data monetization in retail.

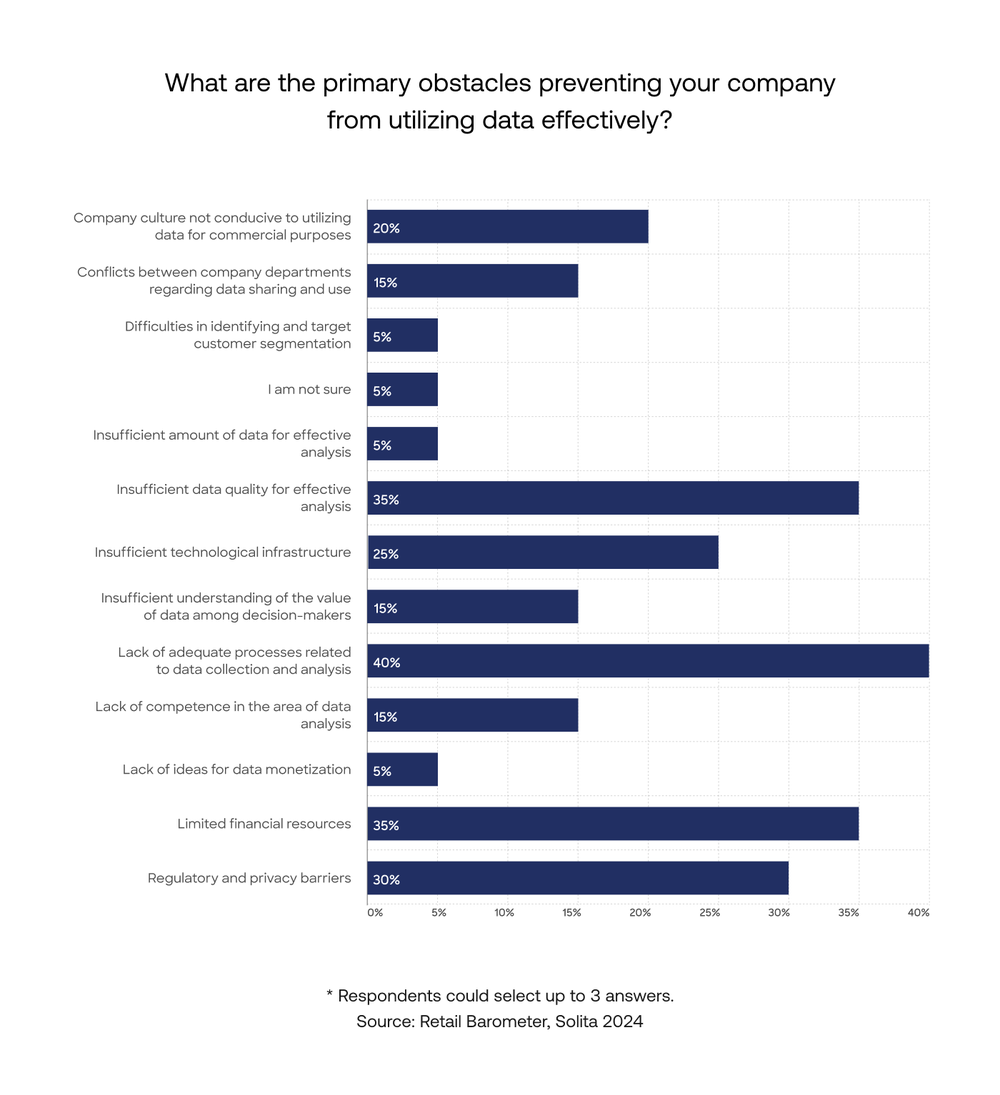

Anders Hedfalk: Amidst all the current talk and hype about Analytics, AI and GenAI – all very strong development trends, for sure – the harsh truth is that it can be very challenging for many traditional retailers to truly manage data, ensure data quality, and capture true value out of data. In fact, 40% of Solita Retail Barometer respondents acknowledge the biggest obstacle as “Lack of adequate processes for data collection and analysis”.

I am not surprised about this response. Retailers are usually quite good at their core business processes like merchandising, logistics, store operations, e-commerce, and marketing – if you fail at one of these, you will soon be out of business. However, when it comes to ownership and processes for, say, definitions and data quality for customers and other key information objects, most classic retailers are at an early stage.

I think the challenge is more about processes, governance, culture, and data literacy, than it is about technology and infrastructure. Retailers should ask themselves: What does it mean and take for us to become truly data driven? Once ownership and data processes are in place, real data monetization can begin

Philipp von dem Knesebeck: In the old days, monetizing your customer data was easy – you'd make a deal with an online marketing data broker, upload your customer’s info to their DMP, and get a few cents each time your data is used to deliver advertising.

Those days are over: Not only did GDPR make this kind of data brokering borderline illegal, but customers started to react very negatively to their data being brokered for marketing. And in highly competitive retail environments, customer satisfaction has to come first.

Luckily, there are smarter ways to monetize your data: By optimizing every aspect of your core business through deep customer understanding. From low-hanging fruits like increasing basket size and shopping frequency through personalized recommendations in your e-commerce and in email marketing across using customer insights for assortment optimization all the way to improving your supply chain, there are gains to be had everywhere.

Additionally, while you can’t sell your data to advertisers anymore, if your multi brand e-commerce has enough reach, you can turn into an advertiser yourself by offering advertising space to the brands available – companies like Amazon and Zalando create five to seven percent incremental revenue just by selling ad space.

Emil Waszkowski: Certainly not the lack of data or a shortage of ideas for its monetization. The main obstacles should be sought in the company culture and the lack of competence to create a data strategy along with a business case for decision-makers. If decision-makers aren’t convinced to invest in data, it's difficult to find the right specialists or establish processes for data collection, processing, and analysis.

The latest results from Solita’s Retail Barometer confirm this – only 5% of respondents pointed to a lack of ideas for data monetization, while inadequate processes accounted for a total of 40% of survey responses. Therefore, investing in a data strategy that will convince the organization to invest in data utilization can yield excellent returns.

Izabela Franke: Certainly, the ability to monetize data requires investment in technology and infrastructure, and a lack of budgetary allocation in this area can undermine effectiveness and efficiency from the outset. It's tempting to say that the biggest problem lies in the lack of strategy in this area.

However, cultural issues pose a much greater obstacle. Building a data-driven culture takes time and equipping people with the necessary competencies. I would rather not say that culture eats strategy for breakfast, but undoubtedly, they have breakfast together at a table full of technological solutions.

Izabela Franke: First and foremost, customers demand more from mobile applications than from desktop websites, especially when it comes to speed and convenience. They exhibit a heightened sensitivity to personalized features, which underscores the importance of tailoring user experiences to individual preferences and behaviors.

Additionally, app users often anticipate the integration of cutting-edge technological advancements into apps – the mobile app sector is evolving rapidly, and users readily embrace new features.

In return, retailers can expect that customers using this channel will be more inclined towards impulse purchases, even though the average order value may be lower compared to other channels.

Moreover, such buyers exhibit higher loyalty to brands, products, or services due to frequent exposure and interactions through the mobile app, which is always at their fingertips.

Emil Waszkowski: Customers using mobile apps tend to be the most valuable, as they collectively spend the most across all channels. They're also more loyal, but with loyalty comes expectations. They expect the brand to know them better, deliver personalized offers, and often even surprise and entertain them.

Furthermore, they also have higher standards for user experience, as the installed app competes side by side with top apps from giants, rather than (often) slower-loading mobile websites.

Anders Hedfalk: The number of customers who use mobile apps will grow as more and more customers are using their smartphones for shopping and other personal and social activities. Especially the younger customers (“Gen-Z”) will develop into mobile app customers, but so will more mature customers who are increasingly using their smartphones.

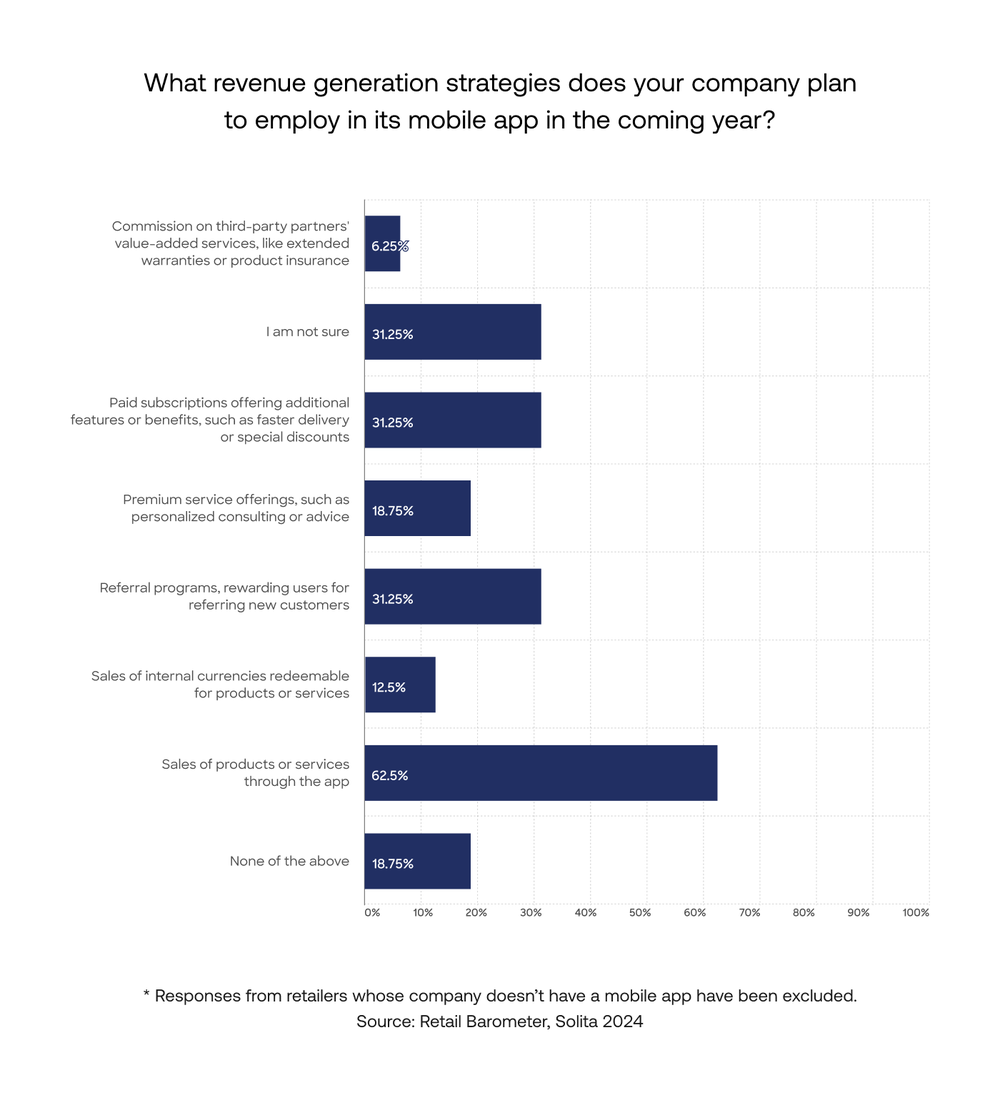

We are in a downturn in 2024, but in the long term, we expect online sales to grow faster than in-store sales. Mobile app users are valuable and loyal customers who choose to interact frequently with the retail brand. Mobile apps can certainly support sales of products and services – product purchases tend to be lower but more frequent – but are particularly suitable for additional services such as loyalty programs, digital wallets, subscriptions, delivery services, and unmanned stores.

“Referral programs, rewarding users for referring new customers,” as well as “Paid subscriptions offering additional features or benefits, such as faster delivery or special discounts,” are growth areas for mobile apps. 31.25% of the Barometer respondents plan to employ these solutions in their mobile apps in the coming year.

An important challenge with mobile apps is that they bring high expectations from customers, both when it comes to in-app services and personalized features and the technical solutions themselves. Customers will compare your mobile app with the ones provided by Amazon and IKEA. A well-crafted development road map and strong technical and data foundation is a good starting point here.

Anders Hedfalk: The last few years have been very tough, with slowing customer demand driven by high inflation and high interest rates. Online sales growth has slowed and returned to the pre-pandemic trend line. The recovery is slow, but 55% of the Barometer respondents expect the performance of the retail industry to improve by the end of 2024.

However, I wouldn’t say that it is a question of prioritizing revenues or cost optimization. Productivity and cost efficiency are always a priority, but after a period of high growth and investments in revenue opportunities or new business, it is wise to refocus on core operations, quality, and customer satisfaction, and prepare for the next growth cycle that always comes sooner or later.

Also, even if the current economic climate is tough, there are many promising growth opportunities out there: e-commerce will continue to grow faster than in-store sales, retail media, which is being pioneered by Amazon and Walmart, has high potential for other retailers, too, especially with growing online sales and customers increasingly using smartphones and mobile apps in stores.

AI and GenAI will continue to develop as the amount of data keeps growing and machine algorithms become even more powerful. Younger customers who have grown up with mobile devices and TikTok are entering the market, driving mobile and social media commerce.

So, retailers need to focus on costs and core operations while simultaneously pursuing new revenue streams. Could also be a good time to prepare the IT system shift you have kept postponing up to now!

Izabela Franke: There is no one-size-fits-all solution. For companies experiencing declining sales or facing financial difficulties, cost optimization is crucial, as it can determine whether they survive in the market or not. Negotiating with suppliers or optimizing inventory management is always a good idea, but it's also worth considering investing in technologies that enable process automation and improve operational efficiency.

On the other hand, for companies in a stable situation, the current economic situation is a great time to invest in new revenue streams, which can ensure long-term growth and competitive advantage. It's truly a great moment to break away from the pack and increase the gap ahead of the rest of the players in the market.

Emil Waszkowski: Both are crucial. Maintaining cost discipline and agile operations should always be a priority. However, cost optimization cannot be endless, and there is always a limit beyond which the impact on growth becomes negative. Therefore, it's worth focusing on finding profitable sources of revenue.

Utilizing consumer data and digital touchpoints with customers in the form of Retail Media provides such opportunities. A great example of this is Walmart, which in 2023 generated $3.4 billion in revenue from advertising and expects to double this figure by 2025, translating to about 10% of the giant's total revenue.

Are you curious to explore the full insights from the report? Download it right now on Solita’s website and stay tuned for upcoming editions providing further updates from Poland’s and EU’s retail landscape.